- Categories: Accounting, AP Automation, Automation, Data, General, Hospitality, Liquor Store, Retail Store, Retailers

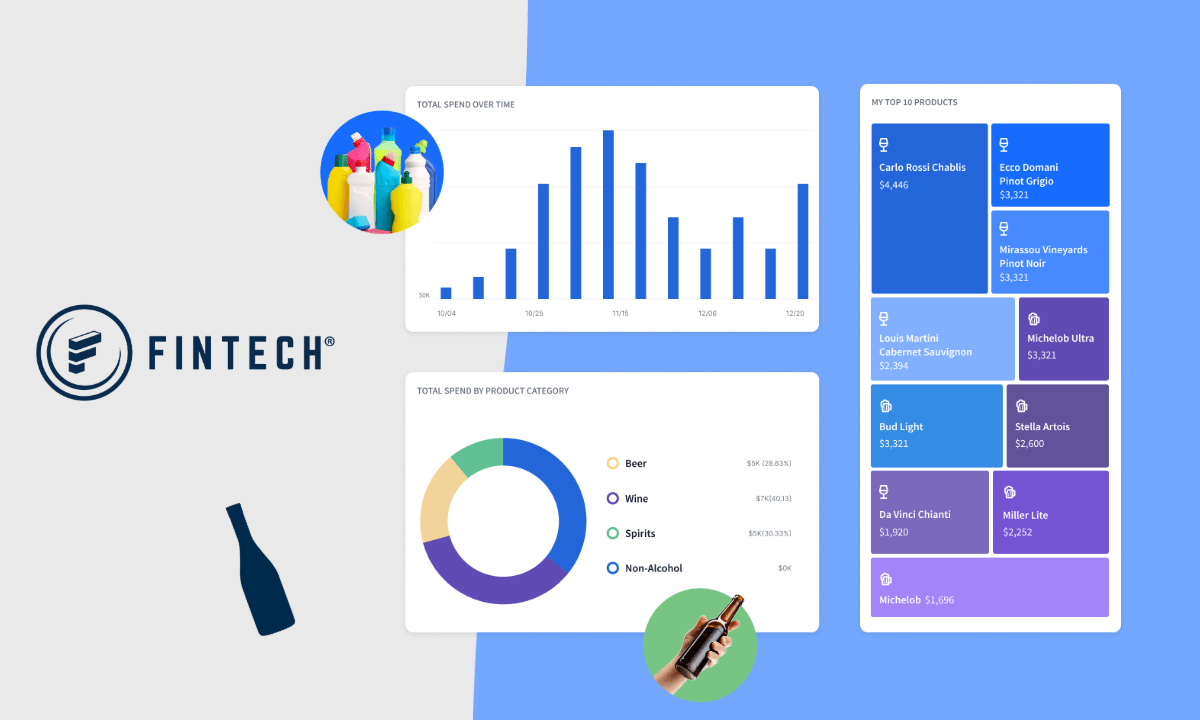

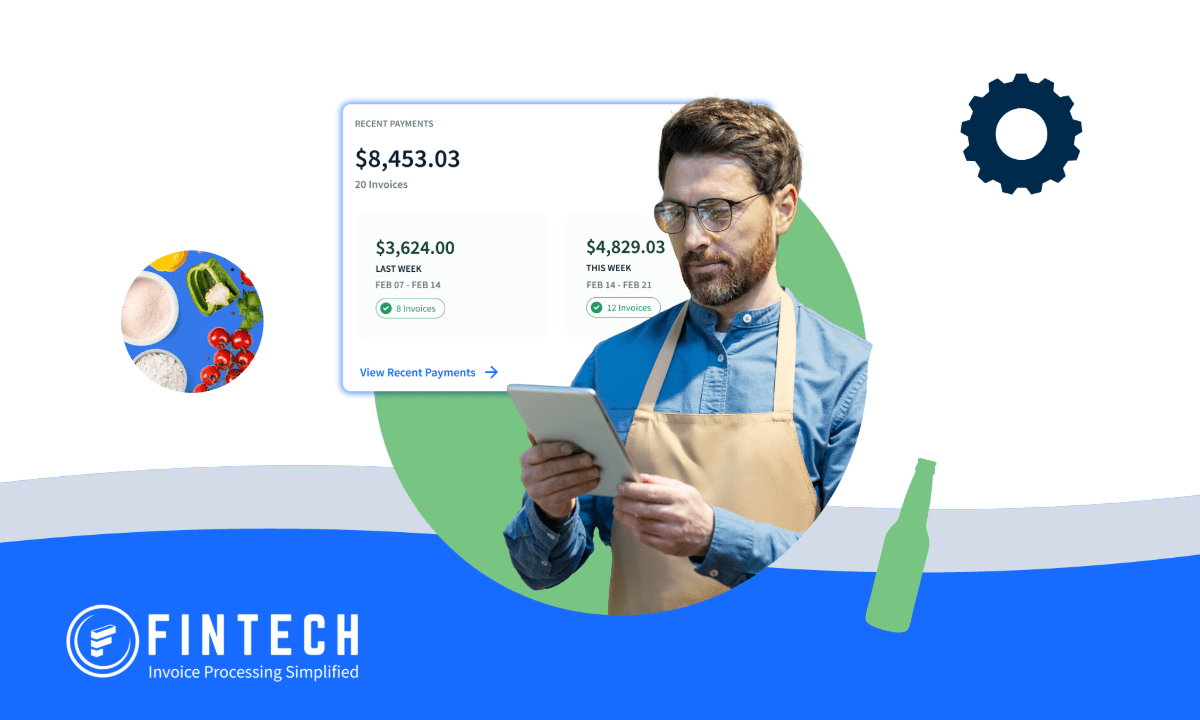

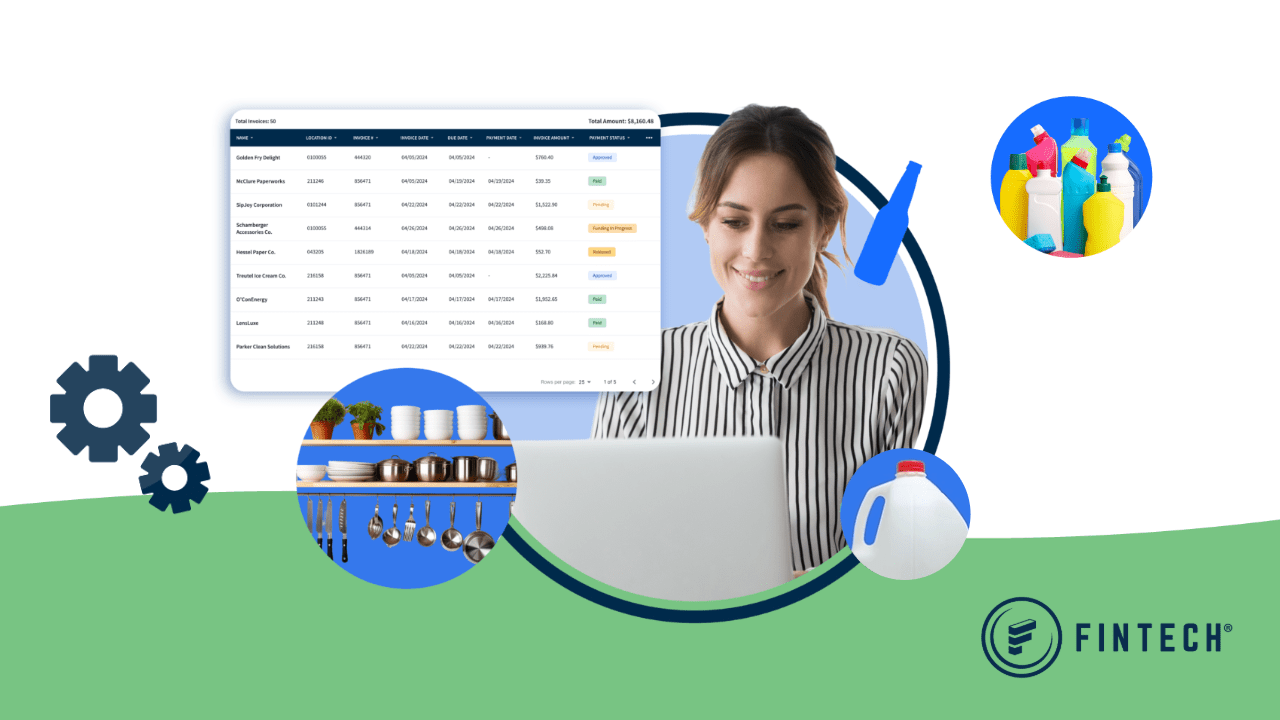

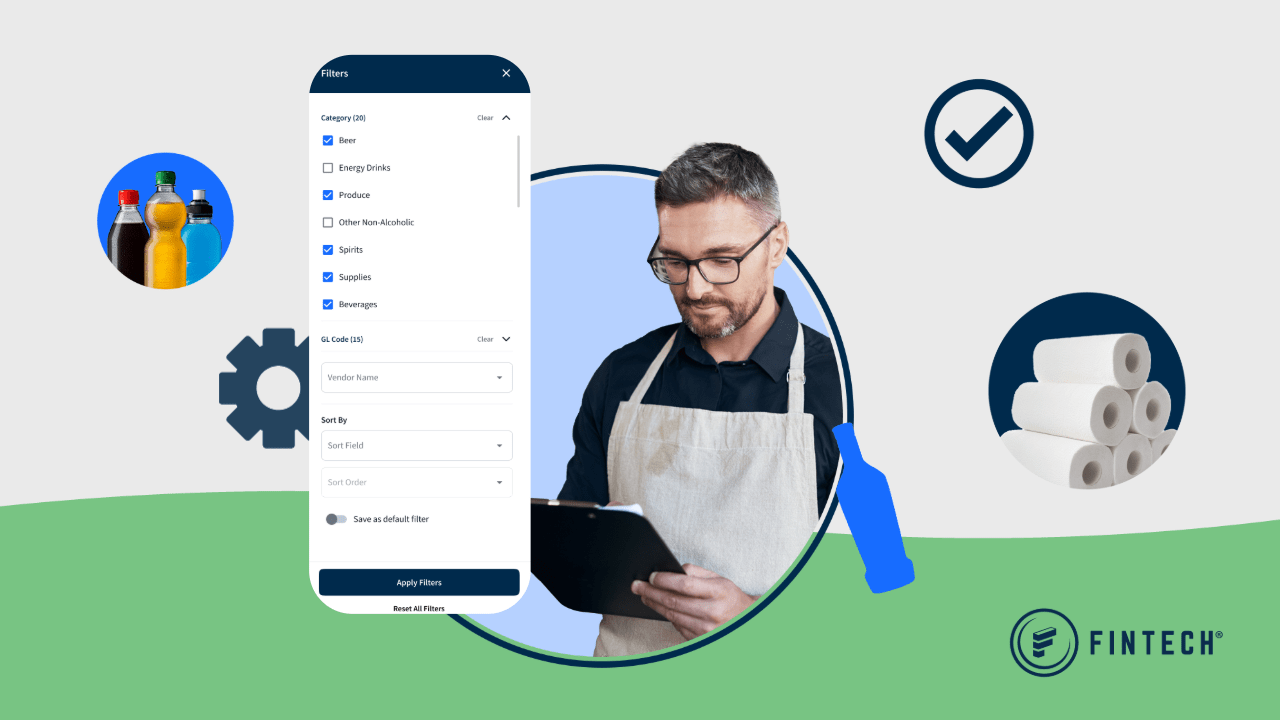

Hospitality and retail businesses must continually monitor and analyze purchasing behaviors across vendors to ensure margin stability and maintain a positive P&L. In doing so, businesses can improve their purchasing based on data that can lead to informed decisions and conversations with suppliers. Fintech’s Spend Overview makes this